Chapter 13 – Accounting for Entrepreneurs

Learning Objectives

- Explain debt and equity financing and the advantages and disadvantages of each

- Identify no-loan financing strategies

- Understand the three primary financial statements: income statement, balance sheet, and statement of cash flows

- Calculate break-even

Once a new business plan has been developed or a potential acquisition has been identified, it’s time to start thinking about financing, which is the process of raising money for an intended purpose. In this case, the purpose is to launch a new business. Typically, those who can provide financing want to be assured that they could, at least potentially, be repaid in a short period of time, which requires a way that investors and business owners can communicate how that financing would happen. This brings us to accounting, which is the system business owners use to summarize, manage, and communicate a business’s financial operations and performance. The output of accounting consists of financial statements, such as the income statement, balance sheet, and statement of cash flows. Accounting provides a common language that allows business owners to understand and make decisions about their venture that are based on financial data, and enables investors looking at multiple investment options to make easier comparisons and investment decisions.

Types of Financing

Although many types of individuals and organizations can provide funds to a business, these funds typically fall into two main categories: debt and equity financing . Entrepreneurs should consider the advantages and disadvantages of each type as they determine which sources to pursue in support of their venture’s immediate and long-term goals.

Debt Financing

Debt financing is the process of borrowing funds from another party. Ultimately, this money must be repaid to the lender, usually with interest (the fee for borrowing someone else’s money). Debt financing may be secured from many sources: banks, credit cards, or family and friends, to name a few. The maturity date of the debt (when it must be repaid in full), the payment amounts and schedule over the period from securement to maturity, and the interest rate can vary widely among loans and sources. You should weigh all of these elements when considering financing.

The advantage of debt financing is that the debtor pays back a specific amount. When repaid, the creditor releases all claims to its ownership in the business. The disadvantage is that repayment of the loan typically begins immediately or after a short grace period, so the startup is faced with a fairly quick cash outflow requirement, which can be challenging.

Equity Financing

In terms of investment opportunities, equity investments are those that involve purchasing an ownership stake in a company, usually through shares of stock in a corporation. Unlike debts that will be repaid and thus provide closure to the investment, equity financing is financing provided in exchange for part ownership in the business. Like debt financing, equity financing can come from many different sources, including friends and family, or more sophisticated investors.

The advantage of equity financing is that there is no immediate cash flow requirement to repay the funds, as there is with debt financing. The drawback of equity financing is that the investor may be entitled to a percentage of the profits for all future years unless the business owner repurchases the ownership interest, typically at a much higher valuation.

Two common equity investors are angel investors and venture capitalists. Angel investors are wealthy, private individuals seeking investment options with a greater potential return than is traditionally expected on publicly traded stocks, albeit with much greater risk. Among the investment opportunities angel investors look at are startup and early stage companies. Angel investors and funds have grown rapidly in the past ten years, and angel groups exist in every state. A venture capitalist is an individual or investment firm that specializes in funding early stage companies. Venture capitalists differ from angel investors in two ways. First, a venture capital firm typically operates as a full-time active investment business, whereas an angel investor may be a retired executive or business owner with significant savings to invest. Additionally, venture capital firms operate at a higher level of sophistication, often specializing in certain industries and with the ability to leverage industry expertise to invest with more know-how. Typically, venture capitalists will invest higher amounts than angel investors, although this trend may be shifting as larger angel groups and “super angels” begin to invest in venture rounds.

No-Loan Finance Strategies

As you’ve learned, many startups come into being through the extensive use of debt. Although borrowing is a legitimate source of funding, it can be risky, especially if the entrepreneur is personally responsible for repayment. In practice, some entrepreneurs max out credit cards, take out home-equity loans against their primary residences, or secure other high-interest personal loans. If the entrepreneur fails to repay the loans, the result can be repossession of equipment, home foreclosure, and other legal action.

We now examine funding strategies attractive to many startups that do not require going into debt or exchanging ownership of the business for financial support (debt and equity financing). The financing methods in Figure 13.1 describe more creative funding strategies.

Bootstrapping

The process of self-funding a company is typically referred to as bootstrapping, based on the old adage that urges us to “pull ourselves up by our bootstraps.” It describes a funding strategy that seeks to optimize use of personal funds and other creative strategies (such as bartering) to minimize cash outflows. Bootstrapping requires entrepreneurs to shed any preconceived notions of the popular-culture image of startups. Most startups don’t have trendy downtown offices, foosball tables, or personal chefs. Bootstrapping reality looks more like late nights spent clipping coupons. It involves scrutinizing potential expenses and whether each cost is really worth the investment. It can be a difficult and trying process, but without any angel investors or wealthy family backers, bootstrapping is often an entrepreneur’s only option. The good news is that this approach can pay substantial dividends in the long run.

Bartering

Startup companies often don’t have a lot of cash assets on hand to spend, but they often have offerings that can provide value to other businesses. Bartering is a system of exchanging goods or services for other goods or services instead of for money. Let’s consider the case of Shanti, a website designer who wants to start a business. She may want to have her business formally incorporated or may require other legal help, such as review of standard contracts. Hiring a lawyer outright for these services can be costly, but what if the lawyer needed something that a website designer could provide?

Whether the lawyer has just started their own business or has been established for several years, they may need a website created or have an old website redesigned and updated. This website overhaul could prove costly for the lawyer. But what if there were a way that both the lawyer and the web designer could get what they wanted with a resulting net cost of zero dollars? Bartering can achieve this. In a barter scenario, Shanti could create a website for the lawyer at the expense only of her time, which in the startup phase is often more abundant than actual cash. The lawyer could provide incorporation services or contract review in exchange, requiring no cash outlay. For many entrepreneurs, this type of exchange is appealing and enables them to meet business needs at a lower perceived cost.

Competitions

There are several organizations that host entrepreneurial competitions which provide financial awards to the winners. These prize funds can be used as seed money to start a new venture. For example, NC State hosts VenturePack Challenge, Make-a-Thon, and Minute to Pitch It at Entrepalooza. You can find out more information here.

Pre-Orders

Another way for startups to gain financial traction is to solicit pre-orders. Consider the launch of a new book or video game. Retail stores will often solicit pre-orders, which are advance purchases of the product. Customers pay for the desired item before they even have access. Although established novel and video game franchises have big fan bases and often large advertising budgets, startups can still find effective strategies in this space.

Crowdfunding

Crowdfunding involves collecting small sums of money from a large number of people. The people who contribute money are typically referred to as backers because they are backing the project or supporting the business idea.

Browsing crowdfunding websites, you will see many different kinds of ventures seeking financial backing—from creating new board games to opening donut cafes. Each project identifies an overall specific funding goal in terms of a dollar amount. Some crowdfunding websites, such as Kickstarter, implement an “all or nothing” model in which projects do not receive any funds unless their overall funding goal is met. The amount can be exceeded, but if it is not met, the project receives nothing. For an entrepreneur utilizing this resource, selecting an attainable funding goal must be a core part of their strategy. The funding goal must also be appropriate to the scale of the project. For example, setting a goal of $50,000 may be reasonable for launching a food truck (which could be a prototype for a full restaurant), but it is a mere fraction of the cost of constructing an entire table-service restaurant, which would come closer to $750,000.

Entrepreneurs vying for crowdfunding usually employ some common tactics. First, they often post an introductory video that explains the project goal and the specific value proposition. (For example, a chef might seek $75,000 to open a food truck specializing in a relatively unknown cuisine.) Second, the entrepreneur provides a more detailed written summary of the project, often including specific items that the funding will pay for, such as $50,000 for a vehicle, $10,000 for graphic design and vehicle decals, and $15,000 for kitchen equipment for the truck. Last is the reward structure, which is what entices visitors to the site to fund the project, offering a return beyond their own passion for the venture. The reward structure establishes different levels of funding and ties a specific reward to each level. For example, for a contribution of $5, the chef might thank the backer on social media; for $25, the backer would get a t-shirt and a hat featuring the food truck’s logo; for $100, the backer would get five free meals when the food truck opens. Fees for these crowdfunding sites vary from 5 to 8 percent.

Accounting for entrepreneurs

Although financing and accounting complement and rely on each other, they are distinct. As we have seen, financing is the process of raising money. Accounting is the system of recording and classifying financial transactions related to a business, and summarizing and communicating those transactions in the form of financial statements. Accounting is essentially documenting what happens to money once a company receives it and thereby makes that information available for reporting to stakeholders and regulatory agencies, and informing business decisions.

At the most fundamental level, an accounting system accomplishes two goals:

- It summarizes a business’s financial performance

- It communicates that performance to owners, managers, and outside parties

The most common approach to accounting used in the United States, and around the world, follows the basic accounting formula:

Assets = Liabilities + Owners’ Equity

Assets are items—such as equipment, cash, supplies, inventory, receivables, buildings, and vehicles—that a business owns and derives future use from. Potential investors want to know what resources a company has at its disposal. Business owners want to see where their money has gone. Let’s return to the case of Shanti, the website designer who starts her business by purchasing a new laptop computer. The computer is an asset that Shanti has acquired for her business.

A liability is a debt that a company has incurred with another party, as when it borrows money from a bank or purchases materials from other suppliers. The business is required to make a future payment to satisfy that debt. For accounting purposes, we want to be able to see what the business owns (assets) compared with what it owes (liabilities). For example, if Shanti does not have sufficient cash to pay for the laptop, she may have the electronics store charge her credit card for the purchase. In that case, the credit card company pays the store, and Shanti’s business now owes the credit card company for the amount of purchase (a liability).

Equity is the owner’s claim on the assets of the business, that is, the difference between what they own and what they owe. Essentially, equity tells a business owner or investor how much the firm is worth after all the debt is repaid.

Financial statements

The three important financial statements are the income statement, balance sheet, and statement of cash flows. Let’s take a closer look at each of these using Hometown Pizzeria as an example.

Income statement

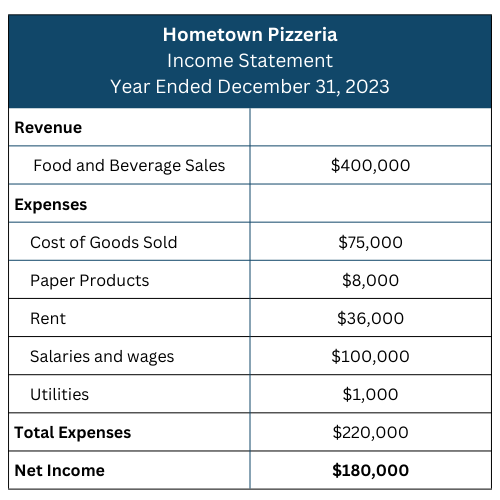

The income statement provides the results of a company’s operations. At the most basic level, the income statement—also called the profit-and-loss statement—describes how much money the company earned while operating the business and what costs it incurred while generating those revenues. An investor wants to know how much money the company brought in from customers and how much it had to spend to get those customers. Revenue minus expenses results in net income, or profit if there are funds left over. Figure 13.2 below shows Hometown Pizzeria’s income statement.

A pizzeria—or any business that sells a physical product—has costs that are specific to the product sold. For example, pizza requires flour and yeast to make the dough, tomato sauce, and cheese and other toppings. We refer to these expenses as the cost of goods sold. These costs are the primary driver that determines whether the company can be profitable.

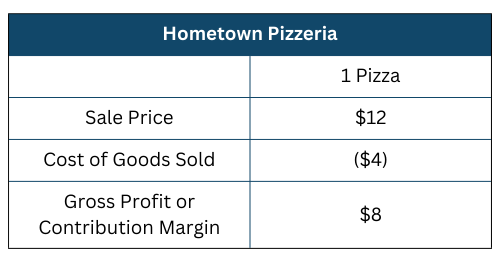

The selling price of an item minus its direct costs—or cost of goods sold—is the gross profit. In a product business, this is the most important operational figure. A business needs to know how much money it makes on each sale because that gross profit pays for all other expenses. If Hometown Pizzeria sells a pizza for $12, the cost of its ingredients might be $4, so the gross profit of selling one pizza is $8. The contribution margin is the gross profit from a single item sold. Therefore, sale price minus cost of goods sold is the contribution margin. (Figure 13.3)

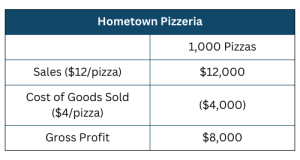

What is Hometown Pizzeria’s gross profit if it sells 1,000 pizzas in a month? (Figure 13.4).

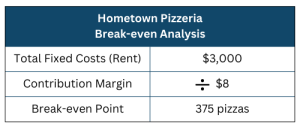

A critical part of planning for new business owners is to understand the break-even point, which is the level of operations that results in exactly enough revenue to cover costs. It yields neither a profit nor a loss. To calculate the break-even point, you must first understand the behavior of different types of costs: variable and fixed. If the selling price of a pizza is $12 and our cost of goods sold is $12, the transaction nets to zero. The company wouldn’t make any money on a sale and is simply recouping the money paid for the ingredients. This is not a feasible business model because there are many costs in addition to ingredients, such as rent on the building, employee wages, and other items.

Variable costs fluctuate with the level of revenue. For Hometown Pizzeria, we see that the cost of ingredients would be a variable cost. Variable costs are based on the number of pizzas sold, with the goal being to buy just enough ingredients that the business doesn’t run out of supplies or incur spoilage. In this example, the cost of making a pizza is $4, so the total variable costs in any given month equal $4 times the number of pizzas made. This differs from a fixed cost such as rent, which remains the same every month regardless of whether the pizzeria sells any pizzas or not.

Once variable and fixed costs are determined, this information can be used to produce a break-even analysis. Calculating the break-even point is simply a matter of dividing the total fixed costs by the contribution margin. To illustrate, let’s assume that Hometown Pizzeria still sells pizzas with a contribution margin of $8 each. Let’s also assume that the only fixed cost is the rent of $3,000 per month. If we wanted to know how many pizzas the owner needs to sell each month to pay the rent, we divide $3,000 by $8. This results in a break-even point of 375 pizzas. Now we know that if the pizzeria sells 375 pizzas a month, its rent is completely paid. Any additional pizzas sold add to the company’s profit. If the business sells fewer than 375 pizzas, it will not generate enough income to cover the rent and will incur a loss. (Figure 13.5)

Understanding the break-even point for a business provides a great deal of insight. At the most basic level, it demonstrates how many units of a product must be sold to cover the expenses of the business and not incur a loss. It may also help business owners understand when costs are too high and decide how many units need to be sold to break even. Realizing this up front can help entrepreneurs avoid starting a business that will result only in losses.

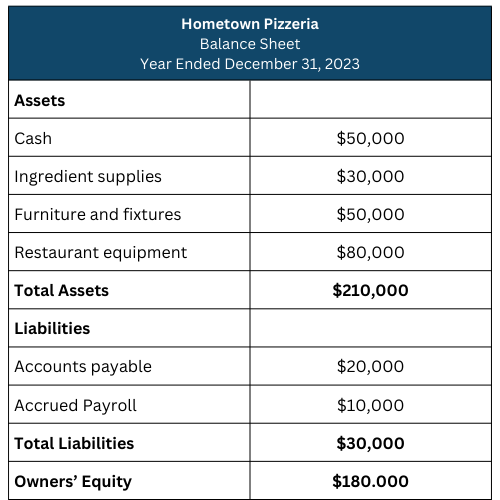

Balance sheet

The balance sheet summarizes the accounting equation and organizes the different individual accounts into logical groupings. As you previously learned, the components of the accounting equation are:

- Assets—items the company owns or will benefit from; examples include cash, inventory, and equipment

- Liabilities—debt or amounts the company must repay in the future; examples include credit card balances, loans payable, and so on

- Owner’s Equity—the share of the assets due to the owners after debt is repaid

Figure 13.6 shows the 2023 balance sheet for Hometown Pizzeria. This is the same kind of financial statement that real-life investors use to learn about a business. You can see the main aspects of the accounting equation in each half of the statement, as well as many detailed individual accounts. This financial statement gives the reader a quick summary of what the company owns and what it owes. A potential investor will be interested in both items. The amount of liabilities is an indicator of how much the business needs to pay off before the investors will see a return on their investment.

Statement of Cash Flows

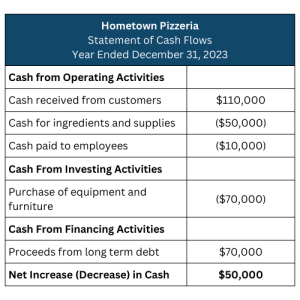

The third basic financial statement we will discuss is the statement of cash flows, which explains the sources of and uses of a company’s cash. You may wonder how the statement of cash flows differs from an income statement. The short answer is that the income statement captures events as they happen, not necessarily when the company gets paid. It records certain items, such as sales, when the work is completed. It is for this reason that the statement of cash flows was developed. It accounts for these differences, only showing activities that result in cash received or cash paid. To better understand the purpose and use of the statement of cash flows, let’s take a look at Hometown Pizzeria (See Figure 13.7).

The statement of cash flows is broken into three sections:

- Operating activities are the day-to-day activities of the business, including purchasing supplies, paying rent, and receiving cash from customers. This section tells a reader how effective the company’s business model is at generating cash flow.

- Investing activities include major purchases of equipment or facilities. This section tells a reader where the company spends money in terms of large acquisitions.

- Financing activities tell a reader where new infusions of cash come from. The owners of Hometown Pizzeria need to find a way to pay for the kitchen equipment and furniture. Let’s assume a bank loaned the pizzeria the money, then we know it will have to be repaid in the future, so the business will need to ensure it is setting aside money to make monthly repayments.

It’s important for entrepreneurs to monitor their financial statements on a monthly, quarterly, and annual basis to track the organization’s progress and determine if it is on track to meeting its goals.

Project Reflection

Pro forma financial statements are important to include in the business plan to seek funding. If you were to move forward with your product, how would you project revenue, expenses, and profits for the next year? What assets would you need to acquire prior to opening the business and where is the source of funding?

Attribution

This work builds upon materials originally developed by OpenStax in their publication “Entrepreneurship,” licensed under CC BY 4.0.

wealthy, private individuals seeking investment options with a greater potential return than is traditionally expected on publicly traded stocks

an individual or investment firm that specializes in funding early stage companies

collecting small sums of money from a large number of people

describes how much money the company earned while operating the business and what costs it incurred while generating those revenues

costs that are specific to the product sold

the gross profit from a single item sold

he level of operations that results in exactly enough revenue to cover costs