Chapter 9 – Entrepreneurial Marketing and Research

Learning Objectives

- Distinguish between traditional marketing and entrepreneurial marketing

- Differentiate between secondary and primary market research

- Describe the seven elements of the marketing mix

Entrepreneurial Marketing

On a basic level, entrepreneurial marketing is a set of unconventional practices that can help start-ups and younger firms emerge and have an edge in competitive markets. The main difference between these and traditional approaches is that entrepreneurial marketing tends to focus on satisfying the customer and building trust by providing innovative products and services that disrupt or appeal to a specific market. Table 9.1 provides an overview of differences between traditional and entrepreneurial marketing.

| Traditional Marketing | Entrepreneurial Marketing |

|---|---|

| Greater amount of resources | Few to no resources; founder drives efforts (sweat equity) |

| Management of an established brand, reminder advertising | Must be ingenious, energetic, and persistent to develop story and brand; leads to trust |

| Financial and market share goals | Satisfaction and awareness goals |

| Manage existing customers | Capture first customers; develop a client base and long-term relationships |

| Manage existing products, promotion, pricing, placement, people, physical environment, and process (the “7 Ps”) | Develop new products, price points, channels (placement), communication, process, training, and design |

| Continue doing what works | Trial and error; market pilots |

| Communication with customers standardized, one-directional; more difficult to create one-on-one relationships | Communication with customers is more fluid and spontaneous; two-way relationships |

As the table shows, entrepreneurial marketing emphasizes flexibility and innovation as a way to stake a claim within competitive markets. For example, consider how Drybar founder Alli Webb used her understanding of market needs to create a niche within the traditional hairstyling industry. A hairstylist by trade, Webb spent five years as a stay-at-home parent, drying hair for friends and family members at their homes to make extra cash. During this time, she realized there was a market need for “just” blowouts, or professional hair drying and styling. Seeing this need, Webb developed a business model that would offer women a way to get a blowout without having to also get a cut or color. Webb didn’t invent the blowout; she just reinvented the space to do it, focusing on that sole aspect of hair styling, and offering the service in trendy settings (See Figure 9.1 below). By being flexible and innovative through a new space to provide this service, Drybar was able to carve a niche in the hairstyle industry.

Market Research

Market research is essential during the planning phases of any start-up; otherwise, you’re shooting in the dark. On a basic level, market research is the collection and analysis of data related to a business’s target market. Market research can entail everything from information on competitors’ products to the interpretation of demographic data related to potential customers.

The main purpose of market research is to gain an understanding of customer needs and wants in an effort to reveal potential business opportunities. When you have a clear picture of what your target market is and what it wants, you can more effectively design your marketing mix to engage that demographic.

Imagine that you are creating a cosmetic line that is organic, contains vitamins and minerals, and is easy to apply. Your target market is women who are interested in high-quality beauty products that are not harmful to themselves or the environment. But after conducting extensive market research, you learn that women aged eighteen to forty-five years tend to be interested in the benefits your product line provides, but that women over fifty years of age are not. In light of these findings, you can either adjust your line’s benefits to serve the market you initially wanted to serve (all women), or you can cater to the needs of a smaller audience (eighteen to forty-five-year-old women).

A good exercise for better understanding your target market is to detail the everyday life of your ideal customer. You can do this by describing in detail a set of possible customers who would buy your product. Details could include demographic information such as gender, age, income, education, ethnicity, social class, location, and life cycle. Other information that would be helpful would include psychographics (activities, hobbies, interests, and lifestyles) as well as behavior (how often they use a product or how they feel about it). The better you know your ideal customer, the better you can focus on capturing their attention by matching their preferences with your offerings.

Market research also helps you understand who your competitors are and how they serve the target market you want to engage. The more you know about your competition, the easier it will be to determine and differentiate your offerings. Let’s dive into how marketers gather all of this data and the value the data provides to entrepreneurs.

Secondary Market Research

Secondary research is research that uses existing data that has been collected by another entity. Oftentimes, these data are collected by governmental agencies to answer a wide range of questions or issues that are common to many organizations and people. Secondary research often answers more general questions that an entrepreneur may have, such as population information, average purchases, or trends. If there is a specific question that cannot be answered, such as how many people would be interested in a new product with certain attributes, then primary research will have to answer that. While some of this kind of research must be purchased, much of it is free to the public and a good option for entrepreneurs with limited financial resources.

Some useful resources are trade organizations that provide information about specific industries, as well as newspapers, magazines, journals, chambers of commerce, and other organizations that collect local, state, national, and international data. Resources such as these can provide information about everything from population size to community demographics and spending habits. Table 9.1 below lists several free databases that are rich sources of information.

| Database | Information | URL Address |

|---|---|---|

| Census Bureau | Economic, demographic, geographic, and social data | https://www.census.gov/ |

| Fact Finder | Economic, population, and geographic data | https://factfinder.census.gov/ |

| American Community Survey | Updated census data | https://www.census.gov/programs-surveys/acs/ |

| Pew Research Center | Fact tank that surveys trends, issues, attitudes, and demographics | http://www.pewresearch.org |

| Pew Hispanic Center | Surveys on Hispanic trends, demographics, and issues | http://www.pewhispanic.org/ |

| Current Population Survey | Monthly survey of US households on labor data | http://www.bls.gov/cps/home.htm |

| Texas State Data Center | State demographic data | http://txsdc.utsa.edu/ |

| IBISWorld | US industry trends | http://www.ibisworld.com |

| Mergent Online | US businesses data | http://www.mergentonline.com/ |

| Demographics Now | US demographic and business data | http://www.demographicsnow.com/ |

Table 9.2

Primary Market Research

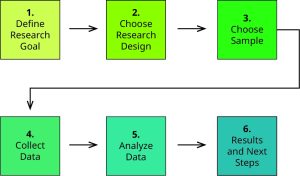

Primary research entails collecting new data for the purpose of answering a specific question or set of questions. While conducting your own research can be resource intense, it is also the best way to get answers specific to your business and products, especially if you want to penetrate niche markets that have not been studied. It also allows you to get specific. By asking the right questions, you can determine people’s feelings and attitudes toward your brand, whether they like your product design, whether they value its proposed benefits, and whether they think it is priced fairly. Figure 9.1 shows the steps common in conducting primary market research.

- Define the Research Goal

- You should start by defining the goal of your research project. What are you trying to find out? The more time you take to clarify your research questions, the more likely you will be to achieve your research goals.

- Choose Research Design

-

The next step is to determine which research techniques will most effectively help you answer your questions. Considering what you want to learn and determining what your budget is will help you decide if qualitative or quantitative research best suits your needs. Well-designed research projects often use some combination of both.

-

Qualitative research uses open-ended techniques such as observation, focus groups, and interviews to gain an understanding of customers’ basic reasons, opinions, and motivations.

- Quantitative research focuses on the generation of numerical data that can be turned into usable statistics. This kind of research most often takes the form of surveys or questionnaires that pose multiple-choice questions with predefined answers.

-

- Choose Sample

- Your sample refers to who you will survey and how many people you will include. In most cases, you will want a sample that reflects your target market, the population who is most likely to purchase your product.

- Collect Data

- Depending on the type of research you conduct, your data collection methods will differ. In this course, most students conduct research through interviews (when the target population is difficult to reach or your target market is business customers) and/or surveys.

-

Interviews are a great method to secure open-ended answers. You might interview potential customers on what they think is the best way to communicate with them, what they like about certain competitors’ products, and get reactions to your product.

-

Surveys can be done by hand or through online tools such as Survey Monkey or Qualtrics. Surveys are very helpful because you can ask questions to current or potential customers about your product, competitors’ products, customer service, and any other information you may seek to create or improve your business. They are an easy way to collect large amounts of data from many customers, and they allow you to calculate responses. Online tools are particularly useful in providing repositories of data that can be later exported to other analytical tools such as Excel or SPSS.

- Analyze Data

- Once you collect your data, the next step is to make sense of it. How you analyze the data depends largely on what you want to get out of it. Typically, you will be looking for patterns and trends among the answers. Data analysis is a field unto itself, and when complex analysis is required, seeking the assistance of experts is often worth the extra cost.

- Results and Next Steps

- At this stage, the entrepreneur seeks to reconcile the results of their research. For example, if you were doing exploratory research about a potential product you wanted to bring to market, now would be the time to ask questions such as whether the research suggests market potential.

Marketing Mix

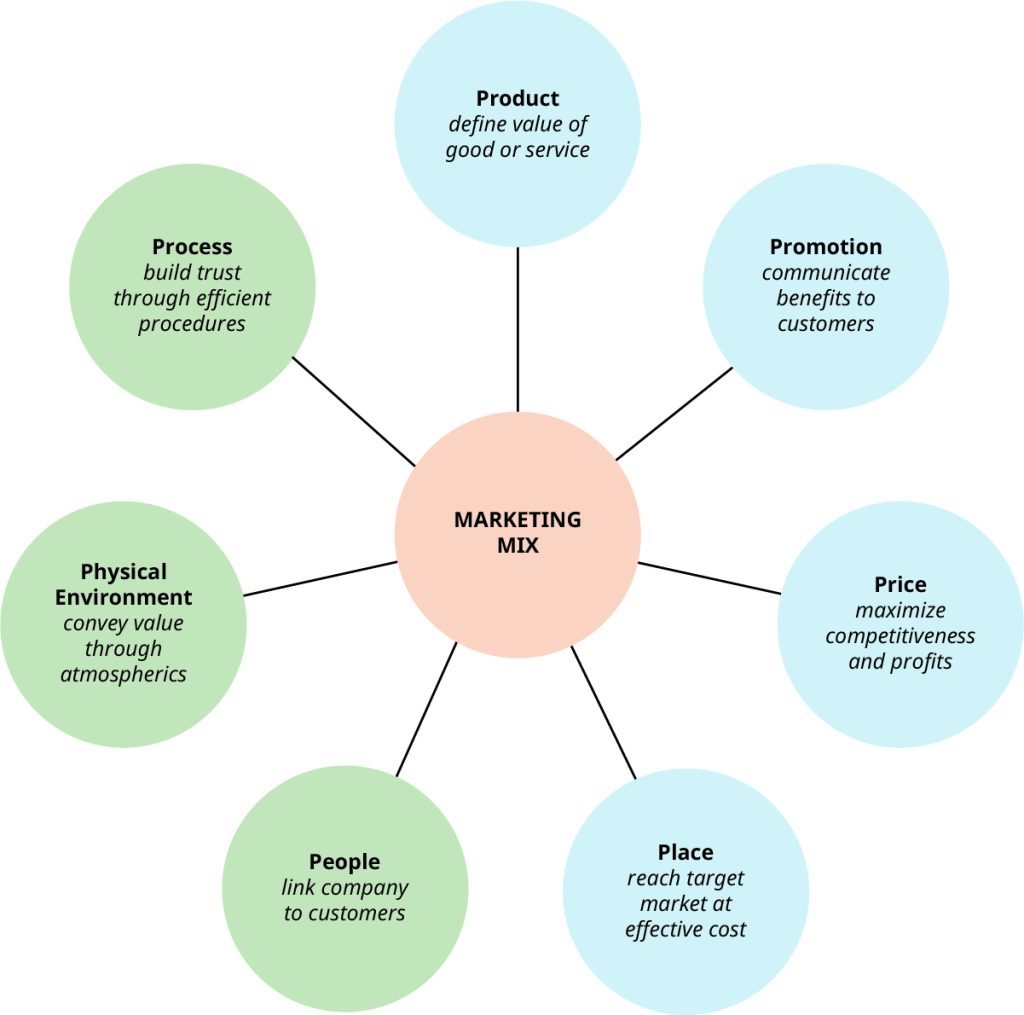

One of the biggest misconceptions people have about marketing is that it is all about promotion, or how a company sells or advertises something. But the truth is, promotion is just one facet of the marketing mix, which describes the basic set of strategies and approaches that marketers use to identify and reach their target market.

One common way of understanding and remembering the components of the marketing mix for products and services is by thinking in terms of the “7 Ps.” While each of these can be part of a company’s marketing mix, the first four relate more to products: product, pricing, promotion, and place (and traditionally have been called “the 4 Ps of marketing”). The remaining three relate more to services: physical environment, process, and people. While the 7 Ps are conceptually the same for all businesses, how a company addresses each “P” will be specific to that company’s needs and goals.

For a better understanding of the marketing mix, Figure 9.3 below breaks down the 7 Ps into their related activities.

Product

Within the marketing mix, product refers to a good or service that creates value by fulfilling a customer need or desire. Goods are tangible products that can be touched, smelled, heard, and seen, such as a pair of tennis shoes, a granola bar, or a bottle of shampoo. In contrast, services are intangible products. They usually entail paying an expert to do something for you, such as car repair or house cleaning.

Companies can bundle both goods and services together to create extra value for their customers. Birchbox, for example, provides goods (product samples) and services (customized product recommendations) to satisfy their customers’ desire to be able to buy beauty products in a hassle-free manner. The value Birchbox provides to customers relies on their ability to do both. In the United States, service-oriented businesses are increasingly playing a larger role in our local and national economies.

For start-ups, defining the value of the products they are going to offer is an important step toward identifying their competitive advantage within a marketplace. On a basic level, if you don’t know what benefit your product provides or what need it fulfills, neither will your customers. Kevin Plank, founder of Under Armour, knew that the value of his product would benefit many athletes who were tired of having to frequently change their wet sportswear. As a former football player, he had spent many hours training and enduring drenched practices, and wondered how he could alleviate this problem that companies didn’t address well with cotton sportswear. After college, he decided to take his idea to the next level and started a company making athletic wear that had special microfibers that kept athletes dry throughout practice and games. He then embarked on a trip to try to sell his value proposition to college football teams on the east coast. Nearing the end of 1996, he landed his first sale of shirts to Georgia Tech, which totaled $17,000—and the rest is history. Under Armour became a strong competitor to Nike and Adidas by providing a new type of athletic wear that has revolutionized performance by keeping athletes dry.

Promotion

Communicating a product’s benefits to customers is a significant aspect of any marketing mix. Even if a product is the best in its class, a company must communicate this value to customers, or it will fail. This is what promotion does: It is the process of communicating value to customers in a way that encourages them to purchase the good or service. Promotions must have a goal, a budget, a strategy, and an outcome to measure. Companies must use their promotional budget wisely to create the best results, which can include sales, profit, and awareness through the use of a cohesive message throughout the campaign.

Some typical forms of promotion are advertising, social media, public relations, direct mail, sales promotions, and personal selling.

Price

One of the most important and challenging elements of the marketing mix is pricing. Price is the value that must be exchanged for a customer to receive a product or service. This is usually monetary and has a direct impact on sales. Correctly pricing your product enables your company to be competitive while maximizing your product’s profit potential.

Here are a few popular pricing models to effectively price your product:

-

Subscription -The subscription model charges customers a monthly or annual fee to use its product, without regard to actual usage. One of the key benefits to this model is that the business obtains revenue up front; however, it is important for the business to monitor usage to prevent attrition. A popular example is a monthly subscription to Netflix.

-

Dynamic – The dynamic model is based on supply & demand and pricing fluctuates. Uber’s rates during busy times of the day will be higher than at less popular times.

-

Market-Based – The market-based model charges customers based on similar products. For example, imagine yourself in a grocery store’s laundry aisle and a variety of detergents are available. These products are priced within a certain acceptable range to consumers and differ only slight from their competitors.

-

Pay as you go – In contrast to the subscription model, pay as you go is based on usage. Your electricity bill is calculated based on the electricity you use each month. If you don’t use it, you aren’t charged.

-

Freemium – The freemium model offers a free version of the product and customers have the option to upgrade for a fee. Phone apps such as Duolingo offer free access with the option to upgrade to Super Duolingo with no ads and a more personalized experience.

Place

Place refers to the channels or locations—physical or digital—where customers can purchase your products; it is sometimes called distribution. For the entrepreneur, the choice of place lies in figuring out which channels will create the most profit. In other words, which channels will reach the majority of the target market at the most efficient cost. Choosing the right distribution channels is one way to create a competitive advantage and generate more success for your business. Certain channels have specific capabilities such as reaching more customers, providing promotions, and providing credit.

Direct channels, such as physical or online storefronts, require no intermediaries and allow you to sell directly to consumers. For example, if you own a bakery, you would likely have a retail storefront that sells directly to consumers.

Indirect channels require intermediaries such as distributors or sales agents to sell your products to the end customer or to other physical or online retail outlets. Indirect channels often have more than one intermediary. For example, to acquire more customers than you could reach on your own, your bakery would use indirect channels such as wholesalers or agents to get your products into local markets and grocery stores across the country. These companies would also help with logistics, which include transportation, warehousing, and handling of products.

People

People, or a company’s human resources, will always be a key factor in any successful business. In a service-oriented business, the people who interact with customers are especially important. Because the service is the product, they are the face of the brand and a direct link between the company and the customer.

When an employee delivers an acceptable or outstanding service, customers are encouraged to return to purchase the service again and also share their positive experience with others. When customers go into a jewelry store and receive good service from the salespeople, they will likely let their friends and family know about the positive experience through a personal referral or on social media.

When service is poor, customers don’t return. If customers have a bad experience at a restaurant, it is likely they will not patronize the establishment any longer and will probably share a negative review online. Sometimes, poor service has to do with factors other than employees, but as online review sites such as Yelp become more common, poor customer service reviews can have a devastating effect on a brand, especially for start-ups trying to break into a market. It is important to hire experienced people and have a good training system in place with rewards that will help employees deliver the best service to customers. Companies should take into consideration that no matter the size of a business, they must market not only to their customers but also to their employees, as they are the face of the company and the ones who interact with customers. Employees can make or break the brand.

Physical Environment

The physical environment where a service is provided is an important part of the marketing mix. It can influence the company’s image and convey a lot of information about the quality of a product, service, company, or brand. The old adage that you “get only one chance to make a first impression” is especially true for new businesses. Tangible cues—décor, smell, music, temperature, colors—send an immediate message to customers about quality and professionalism.

For example, if you walked into two dentists’ offices (remember, they are also entrepreneurs), and one office smelled and looked clean, and one did not, which one would you choose? The same goes for restaurants, retail stores, and any other physical environment. Since a service cannot be inspected before it is received, these cues help customers make their decisions.

Process

Process is the chain of procedures or activities required to provide a service to the customer. It is all of the activities that take place between the service provider and the customer, from beginning to end.

In the case of a doctor’s office, this would include making the appointment, filling out paperwork, waiting to be seen, seeing the doctor, and paying. Because processes can be long and involved, they need to be designed to flow as efficiently and logically as possible. In the case of services that are provided online, process includes the website’s design and functionality, and all of the steps customers take from browsing through check out. A strong website design helps the entrepreneur say what the company is about, what it does and for whom, and what actions the customer can take. Actions can range from clicking for more information, the ability to purchase a product, or checking whether there is availability for a service and being able to book it or make an appointment.

Project Focus

Which primary research method will you use for the project? Your research will give you the information you need to determine if your idea should become a recognizable opportunity.

Once your research is complete, you can finalize building blocks 1-5 on your Business Model Canvas.

Attribution

This work builds upon materials originally developed by OpenStax in their publication “Entrepreneurship,” which is licensed under CC BY 4.0.

the population who is most likely to purchase your product