Chapter 10 – Resource Planning and Legal Issues in Entrepreneurship

Learning Objectives

- Distinguish between tangible and intangible resources

- Determine the venture’s tangible, intangible, and human resource needs and how to attain them

- Distinguish between patents, trademarks, copyrights, and trade secrets

- Develop the ability to identify legal issues

Fundamentals of resource planning

Many entrepreneurs make the mistake of moving forward in their business endeavor without taking enough time to research their industry and determine what resources are required to help their business not only get off to a positive start but also the resources needed for its continued operation. Before we delve into how resources are allocated, let’s examine the general categories of resources needed in just about every new venture: tangible, intangible, and human.

Tangible Resources

As you can imagine, resources needed for the enterprise are varied and can have different attributes. These assets are essential in the operation of the business enterprise. Assets are property or resources that create a benefit to the person (or company) who owns them. They can be tangible or intangible. Tangible resources are assets that have a physical form. They can be seen, touched, and felt. Tangible resources differ between product-based and service-based businesses. A product-based business uses tangible resources in the production of goods sold to customers, such as raw materials, land, facilities, buildings, machinery, computers, supplies, and vehicles. The warehouse shown in Figure 8.1 would be considered a tangible resource for a tire (product-based) company.

Tangible resources for a service-based business include buildings such as a doctor’s office, bank, movie theater, amusement park, retail store, or restaurant, which are enterprises that include both products and services. Facilities and resources that the business needs to provide its services and run operations may include computers, office equipment, furniture, and technological resources. As the figure below shows, the equipment and décor need to be taken into consideration because it becomes part of the product offerings, even if the core product is a service.

Place of Operation

Your facility needs will depend on the type of product or service you are offering and vary in scope from office space to a food truck to a manufacturing facility to a storefront for sales. Knowing the limit of your budget should help you focus on locations that you can afford. Experts recommend that you allocate only a certain percentage of your sales to your lease or purchase; some businesses use industry averages as guidelines. Factors to assess are location, visibility, foot traffic (how many potential customers walk by), how well the building has been maintained, the maintenance it will need in the future, how long you would want to stay in that location, and the insurance, property tax, and renovation costs, or the cost to build a new building. One approach is to make an assessment of your sales per square foot and compare those to sales of similar companies in the same industry or market. This data can be found through local commercial realtor offices, city or county government offices, and local associations.

Machinery/Equipment

Machinery and equipment are critical assets to helping launch a business. For service businesses, such as restaurants, dry cleaners, print shops, etc., the equipment can be expensive. In recent years, however, a larger reseller market has emerged for many types of equipment that are still serviceable.

One example of a more affordable option when first starting out may be renting a shared space. The Kitchen Archive in Raleigh rents out shared and private commercial kitchen spaces to prep and cook food without having to purchase expensive equipment.

Vehicles

For some businesses, vehicles are necessary equipment to run day-to-day operations. You can use your own, which can be cost effective, or you can purchase or lease one. Many small business owners are undecided as to whether buying or leasing a business vehicle nets better benefits.

One difference between the purchase and lease of the vehicle relates to the tax deduction for depreciation. When you own a business vehicle, you can deduct a depreciation value over the life of the vehicle. Generally, you are not eligible to deduct depreciation on a leased vehicle. Ultimately, the decision to lease or buy is one that an entrepreneur should make in concert with a tax advisor.

Technology

No matter what business you are in, you must invest in technology to support your day-to-day operations. This typically includes computers and software, as well as Internet service and intranet/network functionality. The following list includes most of the basic investments you will need to make for your business:

- Computers: Laptops, desktops, and tablets are an obvious necessity for day-to-day tasks, communication, and even production of products or services. Think about the performance and attributes needed to operate the business for insight about what brand and quality to buy. A good operating system that can process calculations and requests faster can make your business operations smoother and more efficient.

- Internet: Every business must have strong and reliable Internet service to ensure connectivity of computers, routers, and peripherals. Communication in today’s environment cannot happen without this technology, and there are many providers that have good packages for businesses to get the bandwidth necessary to operate a business and/or to provide connectivity to customers.

- Router: If you are using multiple computers, laptops, and printers that need to be connected to each other, you will need a wireless router. A wireless router will help you keep documents and printers accessible from anywhere in your office, even if it’s a small home office. You can also have a hard-wired router, which blocks outside signal interference.

- Printer: Most businesses need a good quality printer for printing documents, marketing materials, and forms. Most printers now use color ink and come with the ability to scan and copy documents. They also vary in quality, so you will need to consider your printing needs and the costs of toner/ink to determine the level of quality you need.

- Server: If you need to store and retrieve data—such as customer profiles, emails, and sales information—you will likely need a server. The server is a hardware system with software that performs various functions that cannot be done from one computer.

- Cloud computing: Cloud services have emerged as a cost-effective way to process, store, and use data for company operations. Rather than host your data and systems on your own hardware services, many large companies like Amazon, Verizon, and Microsoft offer web services hosted on a network of computers. This option provides ongoing data integrity and security, while lowering the cost of IT services and equipment.

- Software: There are many software applications and tools that are essential for business operations. These tools support day-to-day tasks. Common software needs include accounting and billing software like QuickBooks, customer relationship management tools such as Salesforce or HubSpot, word processing and spreadsheet software like Microsoft Word and Microsoft Excel, presentation software such as Microsoft PowerPoint, diagram tools like Draw.io, email marketing tools like Constant Contact or Mail Chimp, file management systems like Dropbox, online phone/meeting apps like Skype and Zoom, social media management systems such as Hootsuite, project management tools like Bootcamp, and more. Some of these tools are free. Others carry a cost but may have free trial periods if you need to test them before investing. Most offer easy subscription payment schedules that can be set up monthly or yearly, and include ongoing software updates.

Supplies

There are many other supplies needed to operate the business, mostly basic items that you might take for granted but that need to be expensed: paper, toner, files, staplers, writing utensils, cleaners, and so on. You will likely need basic office furniture too. You may also want to invest in certain amenities that create a working environment and set the stage for your envisioned company culture—whether that’s a coffeemaker, a dartboard in a break area, or whiteboards for meetings and brainstorming.

Licenses and Permits

What types of licenses might be required to operate your business? You may need a basic business license or permit provided by the government for the business to be valid, such as registering as an LLC, partnership, or corporation. These licenses let the government know what kind of activities the business performs and ensure taxes are collected properly. They also make your business a legal entity and prove that it exists in case you need funding or permits. Some businesses require a sales tax license for products and services, whether they are tangible or digital.

Other considerations include professional certifications that pertain to the industry you are working in, such as certifications in accounting (CPA), financial advising, cosmetic services, or healthcare. Many industries require licenses before you can begin to operate; such industries include healthcare, financial services, construction, real estate, insurance, transportation, and engineering. If you will be receiving customers in your home office or storefront, you may be required to undergo a home inspection, especially from the health department if you are in a foodservice industry. Signage outside your business location may also require a permit or compliance with local regulations.

Other permits that may be required for a building include a certificate of occupancy, fire, electrical, HVAC, plumbing, and hazardous materials such as gasoline, diesel, oil, or compressed gas cylinders. Check the laws and regulations of your local and state governments to ensure your business meets the legal requirements for licensing and permits. You can do this by contacting the secretary of state in your state and also by contacting your local chamber of commerce. Importantly, these licenses and permits often carry a cost and should be part of your startup costs with renewals included in your operational budget.

Intangible Resources

Intangible resources are assets that cannot be seen, touched, or felt. Intellectual property—which includes creative imaginings such as formulas, designs, brands, and inventions—is an intangible resource, and so are the patents, trademarks, and copyrights that protect the intellectual property. For example, if you are a small business owner, you might want to protect your logo, company name, website, slogan, new product prototype, or maybe a newly developed manufacturing process that allows you to shorten production time.

In our current technological era, intellectual property has become more important than ever. Patents, trademarks, and copyrights are three protections for this type of intangible resource.

Patents

A patent grants the owner the right to claim the ability to exclude others from making, selling, using, and importing a product or process to the United States for a period of time. This time is usually twenty years from the date the application was first submitted to the US Patent and Trademark Office (USPTO). This allows the inventor to recuperate the costs of researching and developing the novelty before competitors can copy it. Types of patents include utility, business process, design, and plant patents.

A utility patent is granted to an individual who invents or discovers something novel and purposeful such as a machine, a process, a product, an improvement to any of these, or even a composition of matter. Most patents awarded to inventors are utility or plant patents. The USPTO receives more than half a million applications each year

The application and approval process can take several years and can involve a substantial investment that can range from a couple thousand dollars to over $15,000, depending on the complexity and type of patent, as well as the fee for a patent lawyer. Lawyers can help with conducting a patent search and ensuring that the invention doesn’t yet exist, while providing guidance on the application process. Patent attorneys are often expensive, charging between $200 and $800 an hour, but they can make the process easier.

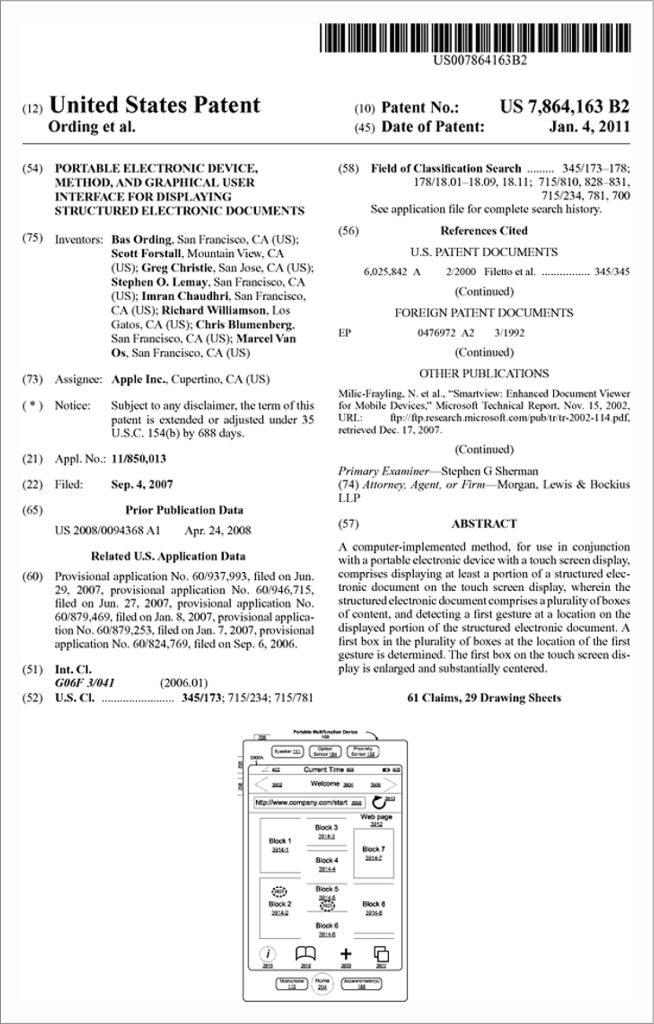

Usually, the first application an inventor files is for provisional twelve-month patent protection, which covers the invention for the first year while the inventor waits for the approval of a final, nonprovisional patent. A patent examiner processes the application and determines whether to award the protection or not. Having the help of a patent lawyer is not necessary, but it usually makes the process easier and increases the odds of receiving the patent. Not having a lawyer can delay the process or prevent the inventor from getting the patent, especially if the inventor is not familiar with the process, or if the invention is complex. Choosing a lawyer carefully is important, as experience and knowledge of the process matters. If the patent is awarded, the final patent goes into effect retroactively to the filing date of the provisional patent, and the inventor has twenty years of protection against other companies copying the design. The figure below shows an example of a patent for the well-known 3-D printer, which was awarded in 1986 to its inventor Chuck Hull.

A design patent is granted to an individual who creates something original and novel as an ornamental design. A design patent involves the actual design of an invention. For example, Apple has hundreds of design patents for its iPhone, and Samsung has hundreds of patents for its various products. (See figure below) shows a patent granted to Apple in 2011. Read the “Abstract” portion. Does it describe something familiar? Every design element, like the LCD screen, the width and length of the phone, and many of its other features that are added to each of its generations, requires a new patent.

Trademarks

A trademark provides the owner the ability to use a name, symbol, jingle, or character in conjunction with a specific good. A service mark is, according to the USPTO, a word, phrase, symbol, or graphic that identifies the origin or source of a service. Both marks prevent others from using those same assets to sell their products. A trademark can be the most valuable asset a company owns. Customers will often pay more for a product or service if it comes from a specific brand with a good reputation. Customers view brands as a promise of the experience they will have: Brands promote confidence in the product and the benefits that the consumer may enjoy. Successful businesses create brand loyalty through these efforts, creating a relationship with customers. When users see themselves in the brand, they will choose that brand to create their own identities.

Protecting the name of the company and its products, jingles, logos, and even social media is therefore necessary to gain and protect a competitive advantage, because among competitors, the trademark is often the only way to distinguish among products. Can you think of a brand you are loyal to—perhaps your Apple iPhone, your Starbucks coffee, or your local entertainment spot? Consider what that company has done to earn your loyalty.

Usually, once the business begins to use its name, logo, character, and other assets, they are informally protected by trademark law and can use the ™ symbol. However, if a business wants extended protection, they should file for legal trademark protection.

Trademarks can be registered at the state or federal level. As the names imply, state trademark registration protects the business’s mark within its own state, and federal trademark registration protects the business’s mark across the United States. Once the registration has been filed and accepted at the federal level, the business can use the ® symbol after the protected item. Examples of trademarks include the Apple name and logo, the McDonald’s logo, the talking GEICO lizard, and Nike’s “Just Do It” slogan.

If you are opening your own candle and soap company, for example, you might want to register your company name and logo initially to prevent others from using it and benefiting from your reputation. If you decide to create a jingle, a slogan, a character, or another branding asset, you can do it while you develop and grow your business, as it can become cumbersome and expensive if it’s done all at once. Getting a trademark itself is not as difficult as getting a patent, but just as with a patent, getting a lawyer’s help can prove beneficial. This type of intellectual property can provide an opportunity for your company to be sustainable for years to come and avoid other businesses copying or using your ideas to promote themselves.

Copyrights

A copyright is provided to an author of an original work, including artistic, dramatic, architectural, musical, literary, and software works. Copyrights are granted by the Copyright Office, which is a part of the Library of Congress.

The US Copyright Office’s website offers a variety of publications that further explain what works are or are not eligible for copyright. While filing with the Copyright Office is not required for copyright (the rights exist when the work is created), the process provides more formal legal documentation to protect your business interests. Registration requires a fee (basic registrations are under $100), and other services or specialty requests may add additional expenses.

Trade Secrets

Trade secrets are oddly similar yet completely different from traditional intellectual property (patents, copyrights, and trademarks.) Trade secrets derive their legal protection from their inherently secret nature, not from a grant of exclusivity by the government. In fact, patents and copyrights are required to be made public, whereas trade secrets are not.

Examples of trade secrets range from the formula for Coca-Cola to the Google search algorithm. An inventor has a choice: patent the invention or keep it as a trade secret. Some advantages of trade secrets include the fact that a trade secret is not limited in duration/time (patents generally only last for twenty years). A trade secret may therefore continue indefinitely as long as the secret is not revealed to the public. However, a trade secret is more difficult to enforce than a patent because the level of protection granted to trade secrets is generally considered weaker when compared with the protection granted by a patent. Additionally, a trade secret may be patented by someone else who developed the relevant information by legitimate means.

Human Resources

Employee costs are typically one of the largest expenses facing a business. Hiring traditional full-time employees can be costly; onboarding them too early can be fatal to a business’s bottom line. Creative approaches to minimizing labor costs can be enormously helpful. One strategy for controlling these costs is utilizing independent contractors (freelancers) and other part-time employees. They do not work full time for the business and may serve other companies as well. Their compensation is generally lower than that of a full-time, salaried employee, often in part because these positions do not usually come with any benefits, such as health insurance or paid time off. Using these workers to fill resource needs can help minimize costs. Once operations have begun to stabilize, it may be possible and ideal to offer full-time employment to these individuals.

Legal Issues in Entrepreneurship

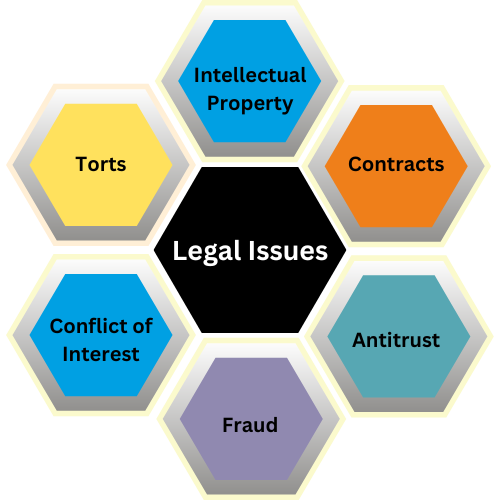

Unlike working in a large corporate environment with an established structure, entrepreneurs often create and operate a new business venture by their own rules. The pressure to create a new venture, within constraints and limitations, inspires entrepreneurs to find innovative ways to meet potential market demands. At the same time, the challenge to meet these expectations can create temptations and ethical pressures as entrepreneurs make a variety of decisions. Common areas rife with potential legal issues include intellectual property, contracts, antitrust/competition law, fraud, conflict of interest, and torts. (See figure below)

Intellectual Property: Patents, Copyrights, and Trademarks

There are multiple reasons why an entrepreneur should be aware of intellectual property rights under the law. For example, if a new startup business comes up with a unique invention, it is important to protect that intellectual property. Without such protection, any competitor can legally, even if not ethically, copy the invention, put their own name or company brand on it, and sell it as if it were their own. That would severely curtail the entrepreneur’s ability to make money off a product that they invented. Intellectual property (IP) rights are created by federal law and protect small businesses from problems such as this. IP law also helps establish brand awareness and secure secondary revenue streams. Please refer to the section above for details on patents, copyrights, and trademarks.

Contracts

Every entrepreneur enters into contracts, usually on a regular basis, and thus should have an understanding of basic contract concepts. Contracts can be formal or informal agreements. Ideally, you should use written contracts whenever you enter into a substantial transaction with another party. Oral agreements are enforceable in most situations; however, proving their terms can be difficult. If you are in the midst of a startup, chances are you are moving quickly. Perhaps you don’t have the time, or the money, to hire a lawyer to prepare a formal written contract. In that event, you should at least follow-up with all parties via traditional mail or email to document the key terms of your agreement. That way, if a dispute arises, you’ll have documentation to fall back on.

Antitrust

Antitrust laws (or competition laws) were developed to ensure that one competitor does not abuse its position and power in the market to exclude or limit competitor access to the market. A few examples of antitrust laws are the Sherman Act, the Clayton Act, the Federal Trade Commission Act, and the Bayh-Dole Act. These acts were created to encourage competition and provide options for consumers. In effect, these laws make it illegal for a competitor to make agreements that would limit competition in the market.

The antitrust concept is important to the entrepreneur’s ability to form new startup businesses that are able to compete with larger, more established corporations (which may try to discourage competition). For example, the Department of Justice blocked the merger between Frontier and Spirit airlines in March 2024, citing that it would hurt consumers who depend on the discount airline industry.

Fraud: Truthfulness and Full Disclosure

Ethical entrepreneurs consistently strive to apply ethics-based concepts in practice, including truthfulness and full disclosure. These two concepts are not only part of an ethical approach to doing business but are also underlying requirements of several areas of law including fraud. A business that makes/sells a product or service has responsibility for fully disclosing the truth about its products/services.

The underlying facts, reality, and evidence behind something are the truthfulness of a matter. An individual who is being truthful is exercising the capability of being factual about a subject matter, dealing with reality, and aware of evidence. Truthful individuals earn a level of credibility and reliability over time because what they say and what they do are in alignment. A corollary of truthfulness is fairness, which means to be impartial, unbiased, and in compliance with rules and standards of right and wrong behavior. Fairness deals with doing what is right, just, and equitable. From the standpoint of application, the quality of being truthful forms the foundation for fairness.

Disclosure describes sharing the needed facts and details about a subject in a transparent and truthful way. This information should be adequate, timely, and relevant to allow the recipient to understand the purpose and intent behind a product/service and to make a good decision about the value of that product/service. Any deliberate attempt to hide, change, or bend the truth is an unethical and irresponsible action subject to criminal investigation.

Conflict of Interest

A conflict of interest occurs when an individual (or company) has interests in multiple areas (financial investments, work obligations, personal relationships), and the interests may conflict with each other. Employees, for example, have an interest in producing expected work for their employer. A conscious or deliberate attempt to avoid, ignore, or marginalize that which is rightfully due an employer by addressing other interests would be a conflict of interest. This could be as simple as using company time or resources to work on a personal project that has not been sanctioned and will not add value to the company. It could also mean using the tangible and intellectual resources of a company on something that will benefit your private interests instead of your employer’s. This action is unethical since you are not giving the employer what they are due, which are your time, talents, and services in exchange for agreed-upon compensation. Consider the example of Mike Arrington, a Silicon Valley lawyer and entrepreneur who created a blog called TechCrunch. Arrington became the go-to source for tech enthusiasts and investors. His coverage of Silicon Valley-based startup companies could help ensure the successful launch of a new business or product. However, he was criticized for routinely covering stories about the companies he invested in and consulted for. Although he provided full disclosures of his interests, rival critics challenged his conflicts of interest. How could he simultaneously be both an investor and an independent journalist blogging about the very companies in which he had a financial interest? He was in a classic conflict of interest position.

Another situation in which potential conflicts arise is in the area of professional services, which attracts many young potential business owners. Perhaps you want to start your own CPA accounting firm, or CFP financial advisory firm, or IT consulting firm. A professional must be very cautious about conflicts of interest, especially in areas in which you owe a fiduciary duty to your clients. This requires a very high duty of conduct and full disclosure, one that prohibits being involved in both sides of a transaction. For example, as an IT consultant, do you recommend to a client that they buy a software product, when unknown to them, you own stock in that company?

Torts

Torts are a potential area of risk for entrepreneurs. Tort law is the area of law that protects the rights of people not to be harmed physically, financially, or in any other way, such as a breach of privacy. Financial liability often results from the assumption of and exposure to risk; therefore, this is an important issue for entrepreneurs to manage. Most employers understand they run a risk that their employees may commit a tort, and that they are responsible when employees cause harm to others (customers or coworkers) while on duty, working on company property, and using company equipment. However, many employers are not aware that employers can actually be liable for harm caused by an employee if that employee caused harm within the scope of their job duties. For example, if an employer asks an employee to drop something off at FedEx or UPS after work hours, and that employee negligently causes an auto accident, even if the employee is driving their personal vehicle and not a company car, the employer could be liable for damages. It is an all-too-common situation that could have serious liability consequences for an entrepreneurial business if adequate insurance is not procured.

Project Focus

Think about the key resources you will need to produce your product from beginning to end. How do those resources work together to form key activities? What partnerships will you need to form to complete these activities? Which resources and activities will have the greatest impact on cost? Answer these questions and you’ll have the information you need for building blocks 6-9 in your Business Model Canvas.

Attribution

This work builds upon materials originally developed by OpenStax in their publication “Entrepreneurship,” which is licensed under CC BY 4.0.

granted to an individual who invents or discovers something novel and purposeful such as a machine, a process, a product, an improvement to any of these, or even a composition of matter

granted to an individual who creates something original and novel as an ornamental design

provides the owner the ability to use a name, symbol, jingle, or character in conjunction with a specific good

a word, phrase, symbol, or graphic that identifies the origin or source of a service

provided to an author of an original work, including artistic, dramatic, architectural, musical, literary, and software works

sharing the needed facts and details about a subject in a transparent and truthful way

that area of law that protects the rights of people not to be harmed physically, financially, or in any other way